You can lead a political party to their financial reporting errors, but you can’t make it fix them…at least not without getting the FEC involved.

– Ancient Investigative Reporting Proverb

At an online state committee meeting of the Democratic Party of Arkansas on August 8, 2020, Chair Michael John Gray said BHR’s article highlighting reporting and accounting errors was baseless. It wasn’t, as anyone who actually read the article knows, but ignoring problems (and hoping others will, too) is par for the course with Gray, so it was not surprising to hear that response.

What was both funny and sad about that meeting, however, is that the party leadership proceeded to confirm many of the issues we raised, all the while misleading attendees into thinking everything was under control and just fine. Except…everything is not just fine. The reporting is still screwed up. It has been screwed up for years. The party has significant monetary exposure to fines from the FEC, especially considering the errors, which grossly misrepresent the party’s financial position to the public, have been pointed out to them publicly again, again, and again.

The point of this post is not to rehash the prior posts, however.

Rather, some new information came to light during and since the August meeting that (again) highlighted why the Democratic Party of Arkansas desperately needs a change at the top.

As you may recall, when Gray was last trying to distract from our reporting about how badly the DPA’s finances looked, he hired a law firm to half-assedly look into the allegations. Part of the firm’s recommendations were that the party undergo a four-year audit of its finances. At the August meeting, there was much discussion about the the status of the audit, which had (at that point) been requested over a year ago.

Gray said that the DPA’s audit committee–formed in 2019 to facilitate completion of this specific audit–had reported to the executive committee in December of 2019 that a four-year audit, estimated to cost around $100,000, would be cost prohibitive. So the executive committee decided not to proceed with the audit. (It was not entirely clear why they waited eight months to disclose that information to the state committee.) Gray then added, without a hint of awareness as to how insane the statement was, that the audit committee had also said the party was missing too many records–such as invoices, receipts, and expense reports–to even do a four-year audit.

It boggles the mind that such records were not kept at the party headquarters, especially since they would not only be integral to reporting, but would be part of standard record keeping in any other organization. It is no wonder the periodic financial reports are so screwed up–there is not even sufficient information to back up the checks that the party wrote.

Perhaps not surprisingly, given what we already know about Gray’s tenure, this is not just sloppy record keeping; it violates Arkansas campaign-finance law, which requires records to be kept for four years:

7-6-206. Records of contributions and expenditures.

(a) A candidate, a political party, or a person acting in the candidate’s behalf shall keep records of all contributions and expenditures in a manner sufficient to evidence compliance with §§ 7-6-207 — 7-6-210.

(b) The records shall be made available to the Arkansas Ethics Commission and the prosecuting attorney in the district in which the candidate resides, who are delegated the responsibility of enforcing this subchapter, and shall be maintained for a period of four (4) years.

Oh, looky! It also violates the FEC’s three-year record keeping requirement:

11 CFR § 102.9 Accounting for contributions and expenditures

(c) The treasurer shall preserve all records and accounts required to be kept under 11 CFR 102.9 for 3 years after the report to which such records and accounts relate is filed.

That is certainly a problem.

As mentioned above, despite calling the BHR allegations “baseless,” much of the August meeting actually confirmed what we had written.1 Case in point, we learned in July 2020 that Fuqua Campbell, PA, was calling vendors and trying to locate missing invoices as part of their representation of the DPA in an FEC audit.2 This information formed part of the background for our post that said that the FEC had “launched an investigation” into the DPA’s finances. Though…maybe Gray did not read the actual post and was taking issue with the “launched an investigation” phrasing. Perhaps he would not think it “baseless” if we had written that headline more accurately, along the lines of: The FEC has launched a full audit of the DPA because the party has already gone through two ADRs (alternative dispute resolutions) due to reporting irregularities (which resulted in settlements where the party paid fines), but now that isn’t an option, so the FEC is doing a full audit that will likely bring a new round of fines. That is a tad long for an article title, however.

At some point between when the blue ribbon3 audit committee was formed and when the FEC audit was commenced, the committee recommended that the party use this new two-year full audit from the FEC to satisfy the earlier recommendation for a four-year audit, rather than paying an outside firm to audit and fix the party’s previous screw-ups.4 In the words of Gray, “We were [previously] allowed the opportunity to go into ADR. We were given the opportunity to pay a fine and not have to do the work and the time and the potential violation things that a full blown audit would do. Our federal compliance attorney recommended that. Once you’ve had them [ADRs] twice, the next one you don’t get that opportunity,” and “this will be a full audit by the FEC, not something that will end in arbitration situation.”

The FEC will have as hard a time auditing missing records as an outside firm would, so expect lots of “potential violation things” and an appropriate level of fines.5

Now, it is important to keep in mind that the errors that we pointed out were related to their public filings, as we don’t have access to their internal records. The irregular items in their public filings were what needed to be audited. Specifically, they needed to look at the public filings as compared to their internal financials and get all the incorrect information off of the FEC reports. Discrepancies discovered in an internal audit usually result in internal accounting control procedure changes. Discrepancies in public filings, especially where the FEC is involved, usually result in hefty fines.6

We first raised DPA reporting issues in August of 2019, and conveniently gave them a road map in our August 2020 article on what needed to be addressed. Given this knowledge of what was incorrect, and given that the FEC was once again looking at the party’s financials, you might expect that the DPA would at least have tried to make sure that future FEC filings were accurate. Or that is what you might expect if the party had competent leadership.

Unsurprisingly perhaps, the vast majority of those errors still appeared on the report filed on December 3, 2020.

What makes this all the more maddening is that, during the August meeting, Gray specifically touted Political CFOs, the new compliance company they hired in the third quarter of 2018 for about $50,000 a year to do the party’s FEC reports. He said, “We do not make a move without first talking to Paul,” referencing the President of Political CFOs, Paul Houghtaling. Gray later added, in a bit of ironic foreshadowing, “Any client Political CFOs has had for a full election cycle has not been audited.”

To be clear, it is unknown whether the current FEC audit covers the 2017-2018 cycle, the 2019-2020 cycle, or both, but all of the previously noted errors are still present in the filings for the 2019-2020 cycle, which ends in 20 days. Meaning, DPA could bring an end to Political CFOs’ unblemished record. Again, despite paying a company to handle the reporting and FEC compliance, nearly every issue we raised regarding errors in the June 2020 FEC report, which dated back to the beginning of 2018, appeared on the FEC report filed December 3, 2020. Pro tip: You guys might want to send Paul articles that light up FEC reporting problems like the 4th of July. See above for recommended reading.7

In explaining and minimizing the party’s errors, Gray said that one example of missing records was bank statements regarding a loan from the First National Bank of Jonesboro (the details of which we previously addressed). He said there were no bank statements in office and that he “had no idea that we even dealt with First National Bank.” To point out the obvious here, one can request old statements from a bank. That loan from FNB has been on the FEC reports for years, and it still appeared on the most recent report filed December 3rd–even though they know it doesn’t exist. This is a prime example of knowingly filing a campaign finance report with false information that is misleading to the public. That non-existent loan, along with all of the other reported debts we pointed out, show they are continually and knowingly filing false information on the financial condition of the party. It is a breach of their fiduciary responsibly at the very least.

The most stunning moment of the August meeting, however, came not from Gray but from party treasurer John Unger, during the treasurer’s report, when he gave whatever the opposite of a masterclass is on why treasurers of political parties should have backgrounds in accounting or campaign finance. Unger quickly rattled off a bunch of numbers for the attendees from the profit-and-loss and balance sheet, but no attendees had copies of, or any way to look at, these documents or numbers. One person on the call, Mary Richardson, asked if Unger would send those numbers out because she wasn’t able to keep up writing them all down.8 His response was very revealing and either accidentally wrong or intentionally misleading:

“At this time we will not share this information. All of our FEC reports are public knowledge, so all this data I just shared with you in even more detail is in the FEC reports.”

When Richardson pressed him further, he said that she could look it all up on the FEC website.9 That statement was so far off base, it would be like making a quick run from Hope to Texarkana by way of Piggott.

Ms. Richardson, we are here to tell you that those FEC reports do not remotely match up with all the numbers you tried to write down, as some of them are not even required to be reported. But extra kudos to you for doing your damnedest to perform the due diligence that you and other committee members should be doing. You led by example in that moment.

In order to truly perform due diligence as a member of the state committee and ask informed questions, you would of course need to be provided several things, beginning with the party’s internal financial statements. In a normal business, that would include the profit-and-loss statement, the balance sheet, and a statement of cash flow. However, DPA Services Corporation, Inc., d/b/a Democratic Party of Arkansas, is a non-profit corporation, so (generally speaking) those reports should be presented as a statement of financial activities (SOA) and a statement of financial position (SOP). Pieces and parts of those could then be (at least partially) matched up with the monthly FEC reports, but not so much with the quarterly state reports. You would need to review the reports in relation to the SOP to find something like, say, a loan to FNB Jonesboro or other various payables listed on the FEC report that don’t appear to exist in the internal records. Since those were obviously not provided to you, we will point out a few things so that you and other committee members can make another run at due diligence at the next meeting:

As a side note, someone in the meeting suggested that DPA increase transparency by making the party’s financials available to the public, but another person was completely opposed to that idea. Generally, all non-profits are required to make the financial statements publicly available and file an annual Form 990 with the IRS, which is also available to the public, but there is an exception: political organizations who are required to file reports with the FEC. Lawmakers probably assumed the FEC filings would provide the same transparency to the public, but as shown below, those reports fall woefully short.10

Unger said the mortgage on the headquarters building had been paid down to $31,725. There’s no way of verifying that with the FEC report, as purchase-money-mortgage loan balances for party owned real estate are not reported to the FEC or the state, nor are they required to be. As such, that is one detail not found on any public report with the FEC or the state. It would appear on the SOP though.

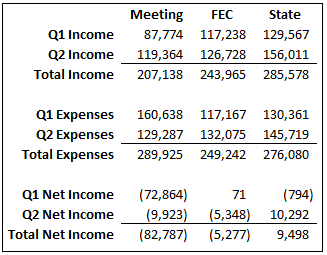

Here are the income and expense figures Unger gave at the meeting, the numbers from the FEC reports, and the numbers from the state reports:

So no, the numbers given were not the same thing as on the FEC reports. Some of the disparity among the numbers might come from the idiosyncratic limitations of the reports, but it is hard to say without having copies of the party’s financial statements. The opaque nature of this information makes it impossible for any state committee member or executive committee member to perform any type of financial oversight and due diligence for the non-profit corporation they are responsible for, especially considering that the FEC reports are littered with errors. Anyone looking at the FEC report would see a party with $49,020.42 cash on hand, and $111,468.27 in payables, which gives the impression the party is insolvent. The actual financial condition is hard to pin down though, as we previously identified at least $35,000 in erroneously reported debts owed by the party, and the equity in assets such as the headquarters building is completely unknown.

Additionally, the FEC reports primarily pertain to the federal account. Some state-account activities are not not required to be reported on the FEC report. Unfortunately, the state reporting requirements are useless to the point of being absurd–there are no opening or closing cash balances; no loan information; any type of refund is counted as a contribution on the report, even though businesses can’t make contributions; disbursements are not broken out by contributions to other campaigns vs. direct operating expenses; etc. Political parties deal with far more money than candidates, yet they have the least restrictive state reporting requirements of any entity, including PACs. Parties only have to report two things: all contributions received (state and federal) and all expenditures made (state and federal). They have to report the total for each and itemize contributions over $50 and disbursements over $100. It is basically a raw data dump of all the incoming and outgoing funds, but the information is not presented in a way that allows for much transparency in terms of determining the financial condition of a party.

All of this brings us back to the four-year audit that had been suggested by lawyers that the DPA actually paid for the recommendation. The audit committee is going to use the two-year FEC audit as a stand-in for the suggested four-year audit. That’s all well and good where the federal accounts are concerned for that two-year period, but party members should be aware there are financial activities not reported to the FEC, as well as some things that are not reported to the state (such as the mortgage loan on the headquarters building). So, relying solely on the FEC’s two-year audit, party members still won’t have a full picture of the party’s finances.

DPA leadership has known for at least two years that their FEC reports were not accurate. They hired Political CFOs to work on them, but either did not give Political CFOs all the documentation needed to do the job correctly, did not have the records they needed, and/or made no effort to do their own due diligence or verify the information on the reports that were being filed. The loan from FNB Jonesboro has been on the FEC reports for many, many years without someone in charge looking at the loan section of the monthly FEC report and saying, “hey, we don’t have a loan there, that shouldn’t be on the report.” The same goes for all the debts owed by the party that appeared on the revised May 2018 report and never went away. This is not rocket science. This is performing base level fiduciary responsibility and looking at a report for things that don’t make sense, just like we did in previous posts.

For an officer to deny a request for party financials to state committee members, who essentially act as board members of the non-profit corporation, and then misdirect the committee member to reports that the party knows are be riddled with errors is a complete breach of their fiduciary responsibility. And like a few other things previously pointed out, it appears to be a violation of Arkansas law:

4-28-218. Books and accounting records.

(a) Each corporation shall keep correct and complete books and records of account.

(b) All receipts of moneys and expenditures shall be properly recorded according to accepted accounting principles.

(c) A record of the proceedings of its members, board of directors, and committees shall be kept.

(d) A record of the names and addresses of its members entitled to vote shall be maintained at the principal office or place of business of the corporation.

(e) All books and records of a corporation may be inspected by any member for any proper purpose at any reasonable time.

Any other non-profit would likely be sued for deceptive practices and breach of fiduciary responsibility and put into receivership until new leadership could be installed. Perhaps coincidentally, the new party rules being adopted at the DPA meeting this coming Saturday will stipulate an officer can only be removed “for cause.” Whatever the reason for that change,11 failing to comply with state law, knowingly filing false information on reports, and directing state committee members to misleading financial information would almost certainly satisfy that “for cause” requirement.

Somewhat ironically, with the money that has been spent on legal and accounting fees and regulatory fines, the DPA could have made the chair a full-time, paid position like the RPA does. And if they then elected a competent chair with the proper skill set who could focus all of their attention to matters like these, they would likely incur fewer fines and legal fees. And, hell, it might even have the added benefit of winning elections more than once in a blue moon.

As the title of this post says, it is time for new leadership at the Democratic Party of Arkansas. Hopefully the next group of leaders will be elected based on skills for the job, such as having a chairman who has led a large organization or division or has non-profit experience, and a treasurer with a background in accounting or campaign finance, rather than being winners of a popularity contest.

Which, if you are playing along at home, is the literal opposite of “baseless,” but whatever.↩

As an aside, the most recent FEC report, filed December 3, shows that DPA owes Fuqua Campbell, PA, $46,428.16. State filings suggest that they have been paid $3,837, though these payments are not reflected on the FEC filings. Regardless, it appears that Fuqua Campbell is still owed quite a bit of money.↩

And not at all as useless as tits on a boar, we swear, guys!↩

Because why bother to be proactive, right?↩

“Potential Violation Things” would make a good title for Gray’s autobiography.↩

As seen previously on CSI: DPA and the FEC↩

Like and follow for reporting errors!↩

We had the luxury of being able to pause and rewind a couple of times to get them all ourselves.↩

This is the point where every GIF related to “SMDH” and “facepalm” flashed before our eyes in rapid succession.↩

When a non-profit is run correctly, it has nothing to hide from the members of the public that fund it. Most people generally agree we need more transparency when it comes to campaign finance reporting, so making the actual financials that show the entire picture available would be a very strong move in that direction, and would help alleviate the need for articles such as this one.↩

And it certainly reeks of desperation or something shady.↩