At this point, you have to wonder what else could possibly come out about Ecclesia College. We already know that the school, through its then-president Oren “Chip” Paris III, was embroiled in a wide-ranging kickback scheme that has resulted in the conviction of multiple people, including former Arkansas legislators Jon Woods and Micah Neal. We know that Rep. Bob Ballinger (R-Hindsville) was involved in at least one land deal for Ecclesia College around the same time as the kickbacks were happening, for which he earned a questionable amount of money in a very short time. We even know that, as of 2017, Ecclesia had a pastor on staff who had been arrested and convicted for child pornography charges in 2000 and who was recently arrested for trying to meet an underaged teen for sex.

With this kind of background, would it surprise you to learn that Ecclesia is also cheating the people of Benton County by not paying required taxes on certain parcels of land in the county?

First, some context: As is relevant here, article 16, section 5, of the Arkansas Constitution lays out that all real property “shall be taxed according to its value.” Subsection (b) of that provision then exempts, among other things, “school buildings and apparatus [and] libraries and grounds used exclusively for school purposes.”

As the handbook given to county assessors explains, “In addition to the constitution one must look to court decisions and statutes when contemplating whether a property is eligible for an exemption.” Moreover, “Exemptions are matters of grace and are to be strictly construed against allowance.”

Because tax exemptions are construed narrowly, the Arkansas Supreme Court has defined “exclusively” pretty literally over the years. In a particularly relevant case out of Benton County, the Court said, “To determine whether property is used ‘exclusively’ for a particular purpose, generally it is necessary to look to the primary use to which the property is put and not to secondary use.”1

Additionally, the assessors handbook notes, that it “may be helpful to know that an entity” is a 501(c)(3) charitable organization or has nonprofit status according to the Arkansas Secretary of State, but neither fact is determinative as to “whether the property of that entity is exempt from property tax.”

In short, regardless of whether an entity is a charity or nonprofit, where a piece of property is used primarily for a purpose that exists independent from school activities and/or the school year, the property is not “exclusively” for school purposes and is, therefore, not tax exempt. Seems straightforward, right?

Well, that apparently depends on whether you ask Benton County or Washington County.

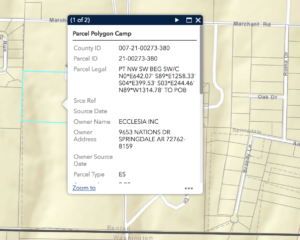

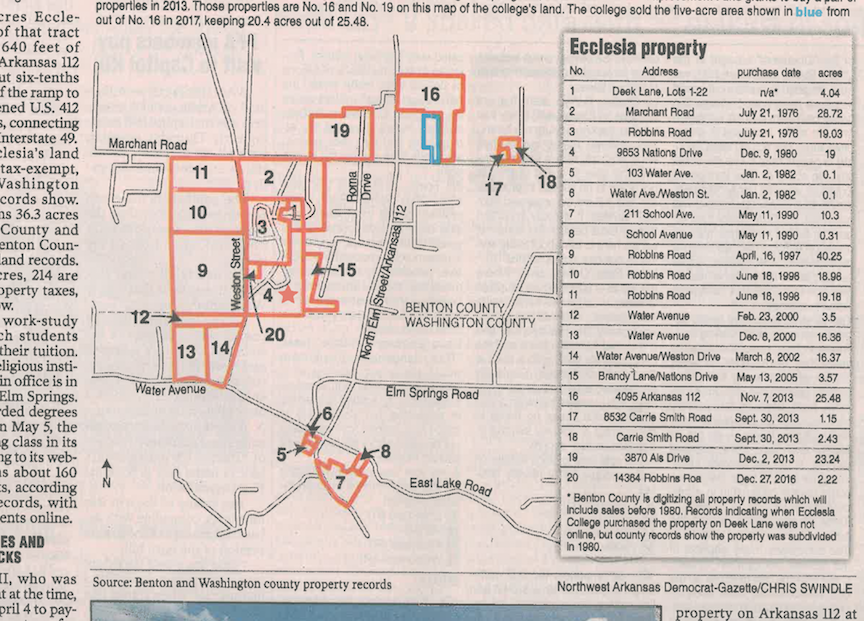

You see, Ecclesia owns multiple parcels of land around the Washington/Benton County line. While most of the property is on the Benton County side, for purposes of this post, let’s focus on the ones marked with red stars (and one red arrow) in this map:

For context, we’re in this area of the two counties:

Now, each of the three parcels labeled on the first map in Washington County are agricultural/farm land, once of which has a couple old farm buildings, but none of which has any school buildings. Accordingly, these are assessed by the Washington County assessor as taxable property, and Ecclesia pays those taxes.

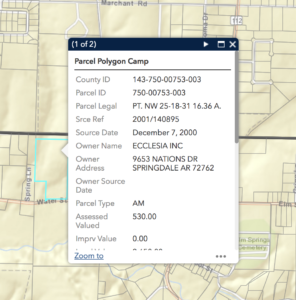

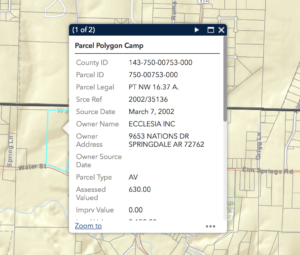

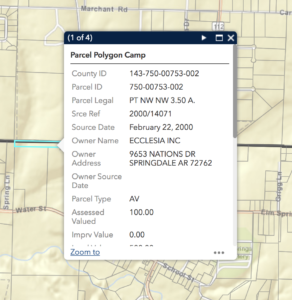

On the Benton County side, however, things are different. Despite the two labeled Benton County properties being unimproved agricultural/farm land, they are treated as tax exempt by the county assessor.

Now, it’s not like the properties in the two counties are appreciably different. Here’s an aerial view of the Washington County properties, and you can see large round hay bales in the field.

And here’s what it would look like if you were standing on the road, looking at the Benton County parcels.

In fact, from above, it is impossible to tell where the taxed Washington County parcels end and the untaxed Benton County parcels begin.

Not that it is just the two hayfields near the county line that Benton County lets Ecclesia improperly take an exemption on. There is als–

/smoke rolls in

/El-P’s “The League of Extraordinary Nobodies” plays over the PA

OH MY! THAT’S…THAT’S BOB BALLINGER’S MUSIC!

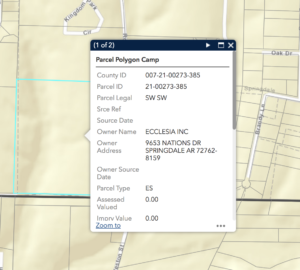

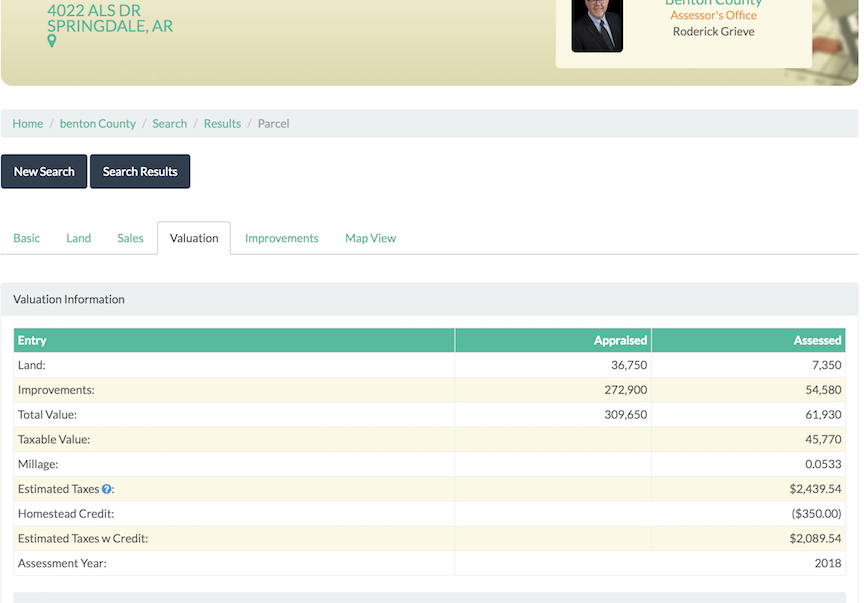

Remember when Bob Ballinger opened Integrity Closing in September of 2013?2 The only real work that we could find that company doing was to help with part (and take credit for all) of the closing on a property purchase by Ecclesia College. That purchase was the property marked as #19 in the map above, and here’s what that property at 3870 Al’s Drive, Springdale, AR looks like:

To me, that looks to be a single-family house with some fields and a pond. The assessment describes the house as a 1+ story, 3100 sqft, single-family dwelling sitting on just over 23 acres. For comparison, a slightly smaller (20.1 acres) piece of land not owned by Ecclesia but adjacent to this Ecclesia property and featuring a similarly sized house like this:

Assuming a similar valuation for the Ecclesia property, that’s roughly $2,000 per year from that parcel alone that Benton County is letting Ecclesia keep.

So…what gives? Why is Ecclesia taxed differently in Washington County and Benton County? Why is Ecclesia allowed to claim tax-exempt status for properties that are clearly not primarily used for school purposes?

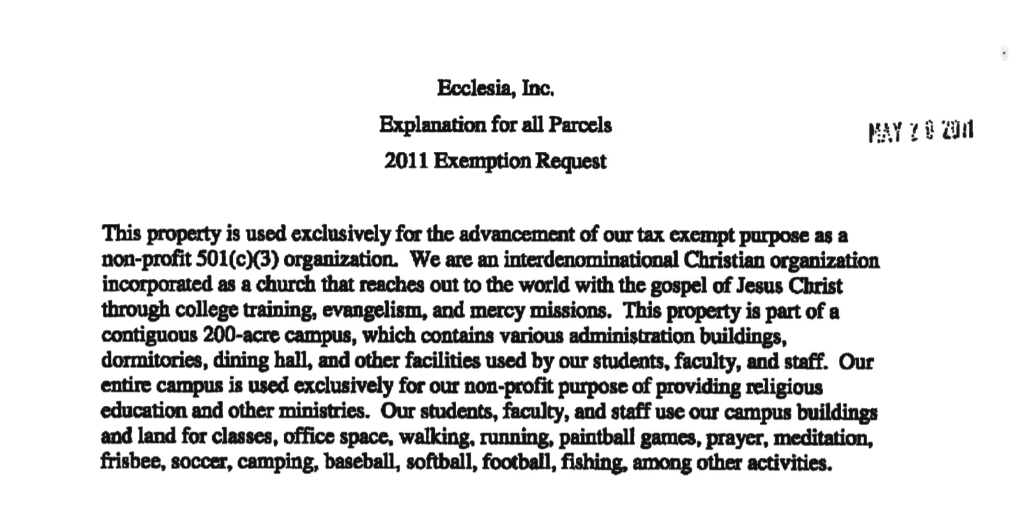

The short answer is because Ecclesia lies about the primary purpose of the land. To wit, here is what Ecclesia submitted as their request for an exemption from property taxes in 2011:

First of all, “contiguous”? That wasn’t true in 2011, and it certainly isn’t true now.

Second, and more importantly, “walking, running, paintball games, blah, blah, blah…”? Seriously? Even if it was true that, at some point, someone had played paintball in those hay fields, that is still completely irrelevant. Remember the test from the beginning of this post? What is the primary purpose of the property? Washington County rightly concluded that the primary purpose of a hay field with hay bales in it was the growing and baling of hay. Benton County, for whatever reason, is willing to pretend like the primary purpose of this:

and and this:

is frolicking and play and meditation and jogging.

Let’s just ignore the complete falsity of claiming that the hay field parcels near the county line are primarily for anything other than agricultural use. There is simply nothing Ecclesia can say that would make that explanation anything other than a ruse to avoid paying taxes. Instead, let’s focus on the 2013 property that Ballinger helped Ecclesia purchase.

Playing devil’s advocate, someone might argue that the house on that property is used for school purposes, as (we’ll pretend) someone who works at the school lives there. Thing is, that Benton County court case that I mentioned at the start of this dealt with specifically that issue. In that case, while the private school claimed that houses on school-owned property were for student guidance counselors, the Court held that the houses were a 12-month residence for the residents, while school was only 9 months long, so the purpose was not exclusively scholastic, and the property was therefore not tax exempt.

Guess how long the Ecclesia College school year is. So, even assuming that someone associated with the college lives in that house, the fact that it is their primary, year-round residence puts it on even footing with case law that already held such houses to not be exempt.

Additionally, in the assessor’s handbook, counties are told, “You may split the property when part is exempt and the other is not.” Therefore, even in the most charitable of interpretations, where the house was found to be exempt, the remaining agricultural land, which doesn’t have a scholastic primary purpose, would not be, and the land could and should be separated to account for the non-exempt portion.

Keep in mind, this is just what we can quickly piece together from GIS, Google, and tax records. There are other properties owned by Ecclesia that also look questionable (at the very least) for tax-exempt status. Rather than actually assess the properties properly and have Ecclesia pay its fair share of taxes, Benton County Assessor Roderick Grieve seems content to just turn a blind eye and let that money go uncollected.

At this point, one suspects that nothing sort of a lawsuit is going to change this reality. This time, however, rather than Benton County being on the right side of the suit like in the earlier case, the county will be on the wrong side, trying to defend a policy that lets an already questionable college profit from overt lies about paintball and meditation.

On the plus side, maybe ol’ Bob Ballinger can find some way to weasel in and make some money in that lawsuit.