One of the Republican candidates for the seat vacated by Paul Bookout, Chad Niell, is the President of Tiger Commissary Services, Inc., d/b/a Tiger Correctional Services. Since the late 1990s, Tiger has provided an increasingly broad range of services to the Arkansas Department of Correction, among others, and they currently provide “inmate food service, inmate commissary, and jail management software.” Part of this business includes “money transmission,” based on Tiger’s involvement with inmate commissary accounts.1

Everyone on the same page so far? Good.

Now, in 2007, the Arkansas legislature passed Act 1595, which adopted the Uniform Money Services Act. Under that act, anyone who “engage[s] in the business of money transmission” must be licensed by the Arkansas Securities Department unless the company or person is specifically exempted under Ark. Code Ann. § 23-55-103. As of this writing, the Uniform Money Services Act has been in effect for well over five years.2

Importantly, the law is clear and unequivocal that anyone who is not licensed or otherwise exempt “may not engage in the business of money transmission or advertise, solicit, or hold itself out as providing money transmission.” SO you would expect that a multi-million-dollar company like Tiger would be aware of this licensing requirement and would apply for a license as soon as possible, if only to avoid any interruption in business.

What you would not expect to see would be Tiger Commissary Services, Inc., filing its first and only Arkansas Money Services Application with the Arkansas Securities Department on June 5, 2013. Nor would you expect that someone who was running for the seat that Paul Bookout resigned due to his failure to follow specific rules and laws regarding money would, himself, be the president of a company that has been operating illegally for nearly six years due to their own failure to follow specific rules and laws regarding money.

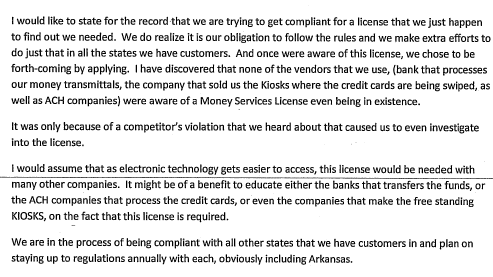

In their application, Tiger does (kind of) address their failure to apply for a license. Their excuse? Basically, “everyone else was ignorant, too!”

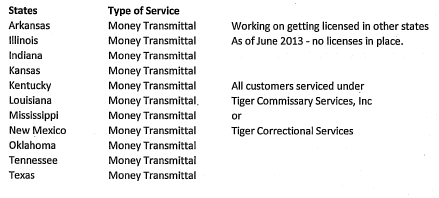

As for that last part, about “all other states,” the application also includes this tidbit:

Uh oh. Illinois has had a Transmitters of Money Act since 1995. Indiana has required licensure of money transmitters since at least 2001. Kansas has required its current form of license application since 2001. Kentucky passed a money transmitters act in 2006. Louisiana? 2006. Mississippi put their current version in place in 2010. New Mexico actually doesn’t require a license unless you are dealing with negotiable instruments. Oklahoma, however, has required application and license since 2007. In Tennessee, it has been required since 1996. And, in Texas, it has been required either since the 1980s or 1991, depending on what Act a money transmitter falls under.

Look at that list, which took all of 10 minutes to compile: Four states required licensure of money transmitters prior to 2000. Eight required it by the time Arkansas did. Yet Tiger, under the leadership of Chad Niell, did not bother to find out about licensing requirements or apply for those licenses in any of those states until 2013? At no point did it cross his mind that, hey, since there are all kinds of rules for traditional banks and financial institutions, there might be some rules for non-conventional monetary institutions as well?

Those aren’t rhetorical questions, either. A failure to get a required license in ten of the eleven states where you do business is a big deal. Operating a money transmission business without a license, without a bond, and without oversight from the appropriate regulating bodies is a big deal.

On a more basic level, when you are running for a seat that was vacated due to illegal behavior, just showing that you can actually follow the law as it relates to your day-to-day livelihood is a really big deal.

The nuts-and-bolts of the involvement are not particularly important, because Tiger would be a money transmitter whether they issued/sold prepaid access or stored value or if they received payment for the transmission of money through unconventional financial institutions.↩

It went into effect July 30, 2007, and licensure began to be required on Jan. 1, 2008.↩