Rep. Ed Garner’s hypothesis, plainly stated, is this: we will encourage more companies to come here and create more jobs, making everyone’s life better in the long run, if we just remove the capital gains tax on new investments. Implicit in that statement is that companies currently do not come to Arkansas because the taxes on capital gains are too high. Under any scrutiny, however, this hypothesis in unsupportable; on the list of reasons that companies don’t come to Arkansas, taxes (including this one) are pretty low, at least according to the experts who measure such things.

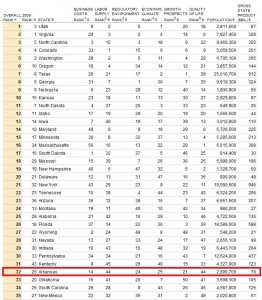

As they have done every year since 2006, back in October, Forbes Magazine ranked every state as part of their “Best States for Business” article. Arkansas came in 32nd overall. Here’s the relevant part of the table:

(Click picture to enlarge)

The first column after the states’ names is “Business Costs Rank,” a measure that includes “cost of labor, energy and taxes.” As you can see, that was the area where Arkansas ranked best, coming in at number 14. Fourteenth in business costs obviously means that 36 states have higher costs in that area. Looking again at the chart, you can see that 19 of those states rank higher overall than does Arkansas. Which means, of course, that it costs more for companies to do business in nearly two-thirds (19 of 31, or 62%) of the states above Arkansas, yet that didn’t keep businesses away.

Taking this a step closer to Garner’s hypothesis, something you can’t see from the chart is that 18 of the states that ranked above Arkansas had capital gains taxes of 4.9% or higher. From 2009 to 2010, those 18 states moved up an average of 3.06 places on this list. On the other hand, the 13 states ranked higher than Arkansas that have capital gains rates lower than ours moved up an average of .08 places, with over half of them standing still or moving down on the list from 2009 to 2010.

The point of all this being twofold: (1) Arkansas’s business costs, which include capital gains taxes, are already measurably better than nearly 2/3 of the states ranked as better to do business in; (2) if anything, this ranking suggests that lower capital gains rates do nothing to make states more attractive to businesses and may, in fact, hinder that effort.

To understand why point (2) makes sense, especially in the context of cutting our already preferential capital gains rate, one look no further than where Arkansas struggled on the Forbes list. We fared worst in “Labor Supply Rank” (measures “educational attainment, net migration and projected population growth”) and “Quality of Life” (looks at “schools, health, crime, cost of living and poverty rates”), ranking 44th in each measure. These are the types of rankings one would expect to see in a state ranked 50th in percentage of people with an advanced degree, 50th in percentage of the population with a bachelor’s degree or higher, 49th in percentage of the population with at least a high school degree, tied for 45th in percentage of the population above the poverty line, 40th in overall health of the population, in the top 10 in firearm deaths per hundred thousand people, 50th in median family income (despite a cost of living that is higher than Houston, Dallas, St. Louis, or Oklahoma City, to name but a few), and 11th in percentage of the population that is obese.

The impact of these problems on Arkansas’s ability to attract business cannot be overstated; while 2/3 of states with higher capital gains taxes rank above Arkansas overall, only one state (Kentucky) with a poorer labor supply ranking and one state (Nevada) with a lower quality of life ranking scored above Arkansas overall. When it comes to the question of “why don’t businesses want to come to Arkansas,” the answer has nothing to do with capital gains, and anyone who claims different is either lying or deluding themselves. This state’s inability to bring new companies here has infinitely more to do with an undereducated, undertrained, underqualified populace and costs of living that are in no way on par with what people actually earn, resulting in high rates of poverty and other problems associated with lower socioeconomic status.

Now, ignoring median income for a second, how are most of these other problems solved? By which I mean, where does the money for schools, police, social services, and the like come from? Taxes, of course.

Yet, despite the fact that the Department of Finance & Administration estimates that a repeal of the capital gains tax would cost $110M over two years, despite the fact that no rational economist suggests that a capital gains cut ever pays for itself, and despite the fact that the math absolutely does not support Garner’s claims about increased income taxes offsetting the losses from a capital gains repeal, he and his ilk are more than willing to decrease the stream of money available to fix the very problems that are ACTUALLY holding Arkansas back in terms of attracting business.

Garner claims that he’s pushing for this bill to increase competitiveness vis-a-vis surrounding states. Yet, ironically, someone actually interested in making Arkansas competitive and attracting business over the longterm would be talking about removing the 30% preference already given to capital gains, with that additional revenue spent entirely on education, public health, and crime. Of course, an increase like that would be anathema to a Republican. It’s much better to speak in generalities, half-truths, and outright lies in order to appease whatever interests you are trying to appease than to actually take steps that would accomplish your stated goals and better the state.

Yesterday, I described Garner’s approach as “damn the torpedoes, full speed ahead!” That’s inaccurate. A better description would be “damn the torpedoes, they’re just going to hit poor people anyway!” Not only is this position unacceptable from a lawmaker, it’s also wrong — if you make Arkansas less competitive, which this bill will do, you hit everyone, from the poor on up.

[Author’s footnote: I mentioned part of this in a footnote to yesterday’s post, but, the more I thought about it, the more I realized that this alone might provide the clearest picture as to why Garner’s entire rationale for his capital-gains cut is incorrect.]