Sometimes a simple question can drag you down a deep rabbit hole, even in another state. This time the simple question was this: how can a person claim to have a woman owned business when her father controls the company?

My response: I dunno. Fraud? ¯\_(ツ)_/¯

It was about Sarah Riggs Amico, a candidate for US Senate in Georgia, and we mainly focus n Arkansas here at BHR. But one solid night of insomnia later, and since Arkansas no longer has a contested US Senate race, here we are… This is the webpage that started this adventure:

Who these people are: Sarah Riggs Amico is running for US Senate in Georgia. She used to be a Republican, but now she’s running as a Democrat. Michael Riggs is her daddy.

A quick Google search of Jack Cooper WBENC yielded an immediate rabbit hole to get lost in. The company has filings with the SEC (the government agency, not the NCAA conference).1

After digging into some of the SEC documents, it became apparent there was something odd about the women-owned business certification for her company, Jack Cooper Holdings. In 2016, the company applied to the Women’s Business Enterprise National Council (WBENC) to get certified as a Women’s Business Enterprise (WBE). They were granted the certification in 2017. How they managed to get it is curious, considering Amico’s daddy, as noted on their website, controls over 70% of the company’s stock, as was also noted in the Company’s 2016 10-K Annual Report filing with the SEC:

Footnote #2 associated with those 632,260 shares of stock owned by daddy states: “All 632,260 shares [78.95%] of Class A Common stock are owned by the T. Michael Riggs Irrevocable Trust of 2014, of which Theresa Lynn Riggs and Janet Brown serve as co-trustees. Mr. Riggs has sole voting and dispositive power with respect to shares owned by such trust.” (emphasis added)

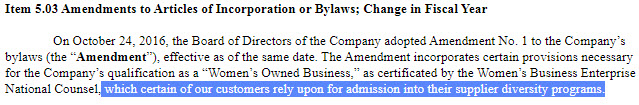

While there is nothing wrong with seeking a legitimate certification as a woman owned business, how a man can control nearly 80% of the voting stock and still get woman-owned status is mind boggling. Why would they even try for such a certification? Well campers, once again, as is often the case for this blog, the answer can be found in a public document, this time filed with the Securities and Exchange Commission:

Ah. There it is. “which certain of our customers rely upon for admission into their supplier diversity programs.” White dude needs a hook to get into a diversity program for preferential treatment, so he finds a willing and able woman: his daughter.

Nice.

The absolute bat-shit crazy aspect of this? They laid the whole damn thing out in public filings with the SEC!2 They even announced it in their March 2017 10-Q Quarterly Report:

“On March 31, 2017, the Company was granted the National Women’s Business Enterprise Certification upon successfully meeting the Women’s Business Enterprise National Council standards. The certification affirms the Company is woman-owned, operated and controlled.”

And to recap from the beginning, the Jack Cooper website, which specifically mentions their “2017 Woman Owned Business Certification” on their homepage, mentioned both the WBE Certification and Mr. Riggs’ control of the company on the SAME webpage. I mean…they weren’t even trying to hide the obviousness of their ruse.

Could it be the certification process is flawed? That line of thinking led me to the WBENC Standards and Procedures for certification, which define ownership and control requirements for certification as a women-owned business.

A. Ownership

1. The ownership by women must be real, substantial and continuing beyond the pro-forma ownership of the business as reflected in its ownership documents.

2. The applicant must share in all risk and profits commensurate with her ownership interest as demonstrated by a detailed examination of the substance of her business arrangements with others.

3. All securities that constitute majority ownership of a business shall be held directly by the woman or women, who are not minors, or held in a trust that is one of the types of trusts described in Section VIII.A.5.e. Trusts.

In going through these three requirements, Amico fails the first requirement miserably, as evidenced by the SEC filings above showing her 0% ownership. It is difficult to imagine how she meets the second requirement considering she has no ownership. As for the third, 78.95% of the stock is in fact held by a trust, but she clearly has no voting or dispositive rights of the stock. Unfortunately, the actual trust document is not available for review. Nonetheless, these are the pertinent WBENC requirements for trusts:

1. Irrevocable trusts. If the trust is an irrevocable trust, ownership held for the benefit of a woman who is not a minor and who is a beneficiary with a present interest in the trust may be counted as owned by women.

4. Trustees. In all cases, all the trustees must be women, provided that a Financial Institution (as defined in the Section VII. Definitions) may act as trustee. (Male co-trustees are not acceptable.)

5. Determination of present interest in the trust. A beneficiary has a present interest in a trust if he or she is currently eligible to receive distributions of income or principal from the trust. If more than one beneficiary has a present interest in the trust, each beneficiary shall be deemed to have an equal interest unless the instrument that creates the trust provides otherwise.

Again, without the trust document, it is difficult to know if she has a present interest, but since she has no voting or dispositive rights in the stock, it is a safe bet she can’t take it as principal. The trustees were also changed to both be women in 2016 to comply with the certification requirement. The trust is in her father’s name, which is a usual indicator that he would be the primary beneficiary. Yet…he has absolute control of the stock, an asset of the trust, even though he is not a co-trustee of the trust? That trust document must be an interesting read!

One would presume the WBENC requirement that “ownership by women must be real” would mean she has some control of her ownership. But as a reminder “Mr. Riggs has sole voting and dispositive power with respect to shares owned by such trust.” It doesn’t sound very much like she has any control whatsoever of the company from that statement. Perhaps there is another place to look to define ownership you ask? Why, yes, yes there is. The SEC has a definition for beneficial owners, and this is a woman owned business, so by definition, women are the beneficial owners, right?3

U.S.C. § 240.13d–3 Determination of beneficial owner. (a) For the purposes of sections 13(d) and 13(g) of the Act a beneficial owner of a security includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has or shares: (1) Voting power which includes the power to vote, or to direct the voting of, such security; and/or, (2) Investment power which includes the power to dispose, or to direct the disposition of, such security.

And as we already know from the screenshot above from the SEC filings showing the beneficial owners, she owns “—”.4 So she has zero control of the company’s voting shares, and does not meet the SEC definition of a beneficial owner.

It would appear her ownership is not very “real”.

Perhaps her control of the company is more real than her ownership.5

The WBENC standards for control state:

The applicant must show evidence that the woman or women owner(s) have control of the business. “Control” means the primary power to direct the management of a business enterprise as evidenced through the governance documents and actual day-to-day operation.

and

A woman business owner or another such woman must hold the highest defined officer position in the company (i.e. President, Chief Executive Officer, Managing Member or Managing Partner, in each case by whatever title).

In amending the company’s bylaws (again, for the sole stated purpose of gaining access to their customer’s supplier diversity channels) they gave Amico the new title of “Executive Chairperson of the Board of Directors” and gave her authority to “have final decision-making authority in the conduct of all business affairs of the Corporation”. They gave her father, who controls 78.95% of the company stock, the title of CEO and the authority, subject of course to the direction and control of the Executive Chairperson of the Board of Directors, to “have supervision over and may exercise general executive powers concerning all of the operations and business of the Corporation.” From a corporate governance standpoint, it is unusual for the chair of the board of directors, which typically performs oversight functions, to have operational control of day to day operations.

So for those having trouble following – Amico’s daddy, Michael Riggs, the CEO, controls almost 80% of the voting shares of the company. That means when stockholders vote for directors, he controls who is on the board, and who the Executive Chairperson of the Board of Directors is – in this case, his daughter Sarah Riggs Amico. The bylaws grant The Executive Chairperson (his daughter) direction and control of The CEO (him). But…if the person you direct and control can replace you? Yeah, that’s not control – real or imagined. Also, daddy could sell the company on a whim without saying a word to her, as he has “sole voting and dispositive power with respect to shares owned by such trust.”6

And if she really holds the “highest defined officer position in the company” one would presume that would make her the principal executive officer, right? Well, her daddy continued to certify all the SEC reports as the principal executive officer of the company pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. In fact, I couldn’t find any SEC reports she certified. But she did get a raise from $200,000 to $425,000 about six weeks before they amended the bylaws to give her “control” of the company.7

So they either were deceptive in getting the certification, thereby being deceptive to their customers, or they were deceptive in their SEC filings.8

And now the company is in bankruptcy. Go figure.

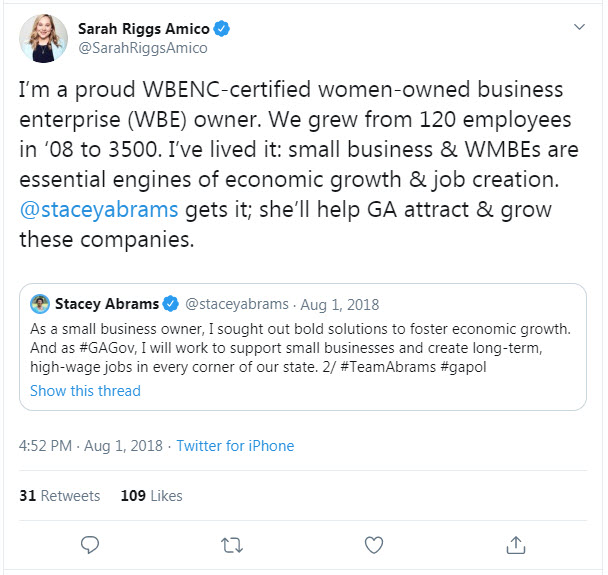

Oh, and she also tried to ride Stacey Abrams’ coattails with the certification while running for Lt. Governor in 2018:

If Sarah Riggs Amico manipulated the WBENC certification process in order to take advantage of their customer’s supplier diversity programs, she cheated the system. And now she wants to be a U.S. Senator – a position of public trust?? One has to worry who might get cheated next…

Yay! Public documents!↩

Pro Tip: Hiding in plain sight, while sometime effective, is never recommended for anyone ever aspiring to hold public office.↩

SPOILER ALERT!↩

known colloquially as: zip. zilch. nada. nuthin. not a damn thing.↩

Bad news for all you control fans…↩

unless he was lying to the U.S. Securities and Exchange Commission when he certified that statement in the reports…↩

A cynical person might call that a “quid pro quo”↩

Choices, choices…↩