As long as we’re knee-deep in economic theory today, I thought I’d touch on something else that’s been bouncing around the Blue Hog Hollowed-Out Volcano Lair: the deficit. After all, you can’t turn on national news these days without hearing someone preaching doom and destruction just around the corner due to the deficit.

As long as we’re knee-deep in economic theory today, I thought I’d touch on something else that’s been bouncing around the Blue Hog Hollowed-Out Volcano Lair: the deficit. After all, you can’t turn on national news these days without hearing someone preaching doom and destruction just around the corner due to the deficit.

Thing is, with very few exceptions, almost everyone who is talking about deficit acts like all deficits are created equal. This simply isn’t accurate. Here, let me give a real-world example:1

Suppose you are in a situation where money is perfectly tight, so that every dollar you take in during a given time period is allocated to some need/cost and there is no “rainy day” fund saved back. You do, however, have a credit card with access to some amount of credit.

Within this scenario, imagine two alternative actions2. In the first, your car suddenly needs a new transmission (and you cannot keep your job or fulfill other responsibilities without a car because you choose to live in the suburbs despite the white guilt it brings), and the cost of the transmission replacement plus a rental car for three days is going to run you $3000. In the second, you are bored at home on a Tuesday night, and you decide that you want to go play Pai Gow with a bunch of Triad members in the basement of a Chinese grocer downtown, which also will cost you $3000.

Obviously, incurring the debt for the first action is the result of having to do what you need to do to survive an emergency that would potentially be worse without the spending; whatever the cost, it is preferable to losing your job and failing at other commitments. The latter, however, is both dangerous and fiscally irresponsible. While the total amount owed is the same in either situation, the former is the type of situation that, all else being equal, will eventually result in you paying off the debt when times are better. The odds that you are the type who will pay off the latter debt are much higher, as you incurred it for no reason and would seem just as likely to do it again as to stop and pay off what you already owe (think “throwing good money after bad”). Eventually you build up a debt that is too high for you to pay off, causing you to default, at which point you either declare bankruptcy or, if you were really irresponsible, get killed by the Triad because you owe them money directly and those dudes do not play when it comes to that.

Extending this analogy to the federal government, the former action is similar to the spending that was and is being done in response to the economic crisis. Yes, we are spending money that we don’t currently have, but that spend is designed to prevent the less-desirable outcomes that we would see if we didn’t spend. At the same time, revenues are down because of the higher unemployment, etc., such that the spending appears to be outpacing revenues by an alarming amount. But what would happen if that spending didn’t occur, and we allowed ourselves to be constrained by the diminishing revenues?

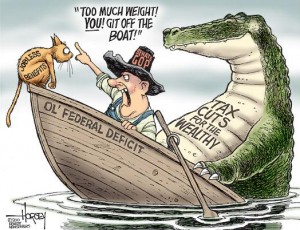

Conversely, the Pai Gow escapade is not completely unlike the deficit we ran under George W. Bush; we were cutting taxes while fighting two wars (a move that had never happened before, and for good reason) and while creating a huge, unfunded drug benefit. We were literally cutting our own revenues, rather than seeing them organically cut by an economic downturn as has happened more recently, while upping our spending across the board. We were the posterchild for Western fiscal irresponsibility.

Why does this matter? Two reasons that I can think of.

First, it means that one must intellectually distinguish between the deficit spending done by the current administration that is/was in response to the crisis and the spending that was done by Bush, at least when we’re talking about debt. Sophistry? Perhaps, but consider: the deficit spending done by Obama has a future payoff, not only in terms of helping the economy stabilize more quickly, but also in lower health care costs and other aid costs to be borne by the government (welfare, for example). The tax cuts, on the other hand, not only kill revenue streams — because who needs revenue, amiright?! — but also have minimal future payout because the money goes to the people who need it the least and are the least likely to spend it soon. (See, e.g., the refusal of corporations right now to spend their horded cash.)

Second, and more importantly, it means that there might not be a single “solution” to the deficit issue. The sense of urgency — keeping people clothed, fed, and sheltered — that drives deficit spending done by Obama will level off as the crisis fades, allowing a steady-if-slightly-slow repayment of those debts. Think “U.S. debts after WWII.” It is money that has to be spent, but the life cycle of the crisis means that the spending will fall and the revenues that remain will be able to cover more and more of the total spending. Even once that sense of urgency is gone, however, the spending is unlikely to fall to a level that will account for the Bush cuts to revenue (i.e. the beloved “Bush tax cuts”). Thus, any plan that relies on keeping those tax cuts cannot be taken serious as an effort to reduce the long-term debt.

***

1 Yes, I’ve previously cautioned against using mom-and-pop analogies when discussing federal spending, but this one seems ok in this context. To quote Walt Whitman,

Do I contradict myself?

Very well then I contradict myself,

(I am large, I contain multitudes.)

2 It’s like a Choose-Your-Own-Adventure book! To stay and help King Arthur fight the dragon, turn to page 27. To run like a scared bunny and incur the derisive laughter of the Knights of the Round Table, turn to page 34.