First, three thoughts.

1. Let’s be really, really clear about what the GOP were saying by demanding all-or-nothing on the extensions. Roughly translated, it was: “We are more than willing to see taxes go up on absolutely everyone, even those who are barely scraping by at current tax levels, if the alternative is raising taxes on the wealthiest Americans by 3%.” Think about that for a second.

2. Everyone who voted for a Republican who ran on the “OMG, won’t someone please think of the deficit?!?!” platform might want to ask that Republican why he or she isn’t interested in cutting $700B from that deficit by letting the tax cuts expire for the top 2%. No matter what Republicans (or, sadly, the President) tell you, the math simply doesn’t work out to suggest that this extension will create an appreciable number of jobs or that it will grow the GDP by even 1% over the next two years.

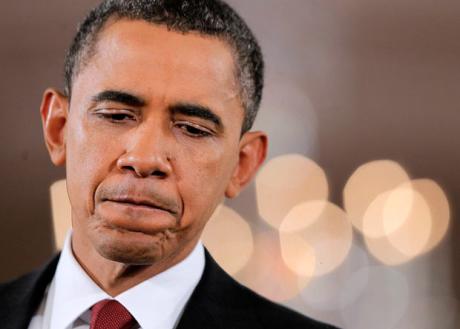

3. At least President Obama managed to get unemployment insurance extended, which, somewhat ironically, will have the biggest impact on economic growth. Extending unemployment coverage is the one thing that makes squandering a position of leverage against the Republicans almost kinda sorta slightly palatable. However, it’s almost comical (in a sad sort of way) how extending the cuts for two years was “worth” extending unemployment benefits for 13 months; considering UI is the best part of the “compromise” by a long shot, was it really too much to ask for the President to demand that UI be extended for the same length of time as the cuts?

Second, the thoughts of economists and economist-type people.

A further thought on the tax deal: didn’t the administration repeat exactly the same mistake it made on the original stimulus? The stimulus was too small; but it also too short-lived, with the maximum impact on growth coming in the winter of 2009-2010, then turning negative just in time for the midterm election.

It is important to realize that most of the money in this package is maintaining tax cuts in place that were scheduled to expire. This will prevent tax increases from having a contractionary impact on the economy, however there is very little, if any, net stimulus in this package compared with current levels of taxation and spending.

In two years, the American people will have a clear choice about who the tax code will favor. That debate will, I hope, highlight the hypocrisy of those wanting to deepen the deficit by extending tax cuts for the rich while simultaneously cutting health care, Social Security and domestic public investments in the name of deficit reduction.

This is expansionary fiscal policy, alright, but a large chunk of it is concentrated in exactly in those areas — like tax cuts for the rich — which have the lowest multipliers when it comes to kick-starting economic recovery. What the country needs is spending, and this bill instead looks very likely to give us hundreds of billions of dollars of saving.

The unemployment-insurance and payroll-tax aspects of the deal will be welcomed as exactly the kind of stimulus this economy needs: substantially all of them will be spent rather than saved. But the middle- and upper-class tax cuts, paid for by extra borrowing by Treasury, will be used in large part to pay down personal debt. Essentially, we’re replacing private debt with public debt. Just like Ireland!