As previously mentioned in Matt’s article last Tuesday, there have been some serious issues with DPA’s reporting compliance in the past, and the FEC report troubles were the canary in the coal mine. DPA Chairman Michael John Gray insists the canary is only…resting!1

The previous article had this line in it:

Unfortunately, FEC filings do not mirror everything that happens at the state level, and the state level filings don’t mirror federal filings.

That statement is mostly true, however, according to the Arkansas Ethics Commission’s Advisory Opinion 2003-EC-004, all federal contributions must be also be reported on state quarterly reports:2

The term “contribution,” as defined by Ark. Code Ann. § 7-6-201, makes no reference to the purpose for which the contribution is received in determining whether or not the money or item is indeed a “contribution” which is required to be reported. Rather, the definition includes “anything of value received by a committee.” Accordingly, it is the Commission’s opinion that all “contributions” received by a political party should be reported by the party on its contribution reports filed quarterly (previously, annually) with the Secretary of State, notwithstanding the fact that the party may choose to place such contribution in a designated account for use in federal elections. In other words, the fact that a contribution may ultimately be used by the party in a federal election does not remove it from the definition of “contribution.”

One way of restating that would be this: if someone gives a political party anything of value, (say, for example, cash, check, money order, or wire transfer) and the party accepts it and/or deposits it in their bank account, they have to report it. When one takes this reporting requirement, along with the requirement to report all disbursements, it would stand to reason that one could theoretically reconcile all of the party’s bank statements against the quarterly reports. 3

In spot-checking some reports, (*spoiler alert*) things didn’t always match up that way.

FEC reporting is complex. Lots of things have to be categorized in many different ways. There are items called “conduit payments” that have to be reported, but don’t show up directly as itemized contributions. To find them, you have to dig into the raw data of the reports and locate the memo items.

So, let’s say you are at a fundraiser, and it is a joint fundraiser where DPA is collecting donations for the State Victory Fund. They collect that money, put it in the bank, then send it to the Victory Fund for the fund to hand out to candidates. In other words, in this instance, the DPA is a conduit just passing the money along. They then are supposed to report the Victory Fund money from the individual donors as a memo item on the next FEC report, because, again, the DPA received a thing of value, even though they just passed it along.

So, if they received a thing of value, then, under the Ethics Commission rules, that means it will be on the state report. Right?

I know this will be shocking, but…the memo items aren’t on the state reports. They don’t show as coming in or going out. Those items total $50,207.62 for the first quarter of 2018 alone.4

To be fair, yes, these are clerical, data entry/reporting issues. These are zero-sum transactions, and we found the exact same issue on some RPA reports.5 But, nevertheless, let’s unpack a paragraph from one of Gray’s emails that went out to the party leaders last week:

“Our party, like most state parties, relies on a compliance company to file state and federal expenditure reports. No one on staff is responsible for filing those reports. Any allegation that potential errors on reports are the result of staff action is false. This has been a practice at the party since before I arrived. Though, I understand that I remain ultimately responsible for the reports, as your Chairman.”

Our party, like most state parties, relies on a compliance company to file state and federal expenditure reports.

I immediately pulled the RPA filings to see who they use, and turned up…nothing. Perhaps I’m just missing it, or maybe the CPA firm they use up in Bentonville is doing it for them. Other than that, I don’t see a big national compliance firm on their reports.

No one on staff is responsible for filing those reports.6 OH REALLY?!?!

7-6-223. Reports of contributions by political parties.

(a) Within fifteen (15) calendar days after the end of each calendar quarter, each political party that meets the definition of political party stated in § 7-1-101 or that has met the petition requirements of § 7-7-205 shall file a quarterly report with the Secretary of State.

Curious. I don’t see where it says a third party compliance company shall be hired to file reports for the party to shield them from any and all possible errors. Furthermore, if nobody on staff is responsible for filing those reports then:

- Why does Michael John Gray sign all the reports (or more accurately, allow his name to be stamped on them) saying they are accurate instead of the compliance company?

- Why does Karyn Bradford-Coleman notarize the reports instead of the compliance company?

- Why, according to the minutes of the last executive committee meeting, was Karyn Bradford-Coleman going for a one day compliance training as a result of the fines paid to the FEC? I mean, if nobody on staff is responsible for anything related to the reports, why do they need training? Maybe it’s highly specialized compliance training to learn not to be responsible for anything.7

Any allegation that potential errors on reports are the result of staff action is false. 8

This statement raises all kinds of questions. First up, see question 3, above. How does the compliance company get all the information for the reports?9 Who notes what expenses were for and how they should be categorized?10 Who reconciles all of the contributions and expenditures against bank statements?11 How often does the accountant for the party check over stuff?12 And of course, if the staff is completely absolved of any errors on the reports, why did the FEC fine the party…TWICE?13

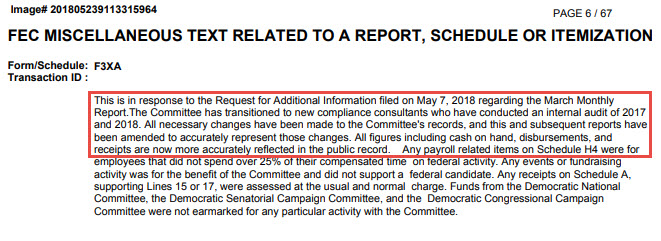

As noted in one of the FEC’s RFAIs, on May 23, 2018, just over a month after filing their one-page state quarterly report, the DPA filed an amended report for March that included this statement:

So all figures are now more accurately reflected in the public record. Well, I guess there’s always room for improvement, eh? And if a new compliance company was doing an internal audit, I presume that’s an internal audit of the party’s records, and those changes had to be made to the party’s records, which Gray claims they are not responsible for, because…?

This has been a practice at the party since before I arrived.14

Just because it’s the way it has always been done, doesn’t mean it’s right. See, e.g., the old practice of legislators taking “reimbursements” for money they never actually spent or constitutional officers using state cars while in office. Both practices had existed for years, until they were pointed out by someone and were ultimately stopped due to being illegal.

But hey, these DPA errors were all just clerical errors. No harm there, right? I mean, it was just clerical errors…that resulted in 22 RFAIs and amassed nearly $18,000 in fines from the FEC. No damage to the party, right?

And what about those compliance companies? How much was paid to them in addition to the fines to the FEC? From August 2017 through June 2018, it was $17,400 across two companies, Next Level Partners and Roger That Compliance. Additionally, they paid a company called Political CFOs over $24,000 in the first half of 2019 alone for “accounting and compliance services”.

Call me crazy, but I thought collecting money and properly categorizing and reporting it was kind of a primary function of the party. They sure are spending a lot outsourcing what I would think would be a primary party function.

But when do clerical errors turn into real problems that could go so far as to turn into something more serious, like say, a Class A Misdemeanor?15 When you knowingly submit false reports.

Let’s be perfectly clear: the DPA knew things were messed up with their financial filings as far back as 2018. They publicly stated in the FEC filing on May 23, 2018, that they had transitioned to a new compliance company who had completed an audit of 2017 and into 2018 and filed corrections. More importantly, they knew the numbers were not correct when they intentionally filed a one-page report with nonsense numbers and no schedules, which means they failed in their duty to file. We know they knew the numbers weren’t right, too. This is because they filed their one-page first-quarter report with the state on 4/24/2018 (9 days late), which was 4 days after they submitted their original filing with the FEC on 4/20/2018 covering the month of March, which had nothing but zeros on it.16

You do the math.

We could keep going. We could (and may still) write about how much has been spent fixing clerical errors and outsourcing the reporting of clerical errors, how the party is tens of thousands in debt, how it has the highest filing fees in the nation, how it let 56 of 100 House seats go unchallenged in the last cycle, or how it suddenly had $13,000+ in unitemized expenditures in Q1 2019.

But, as for now, my brain is tired, and I most certainly did not pay for an argument.

Remarkable bird, the Norwegian Blue, idn’it, ay?↩

‘e’s stunned!↩

*checks canary* He’s really pining for the fjords!↩

‘ELLO POLLY!!!!↩

The RPA actually requested the advisory opinion, so it’s a little ironic they screwed this up too.↩

The Norwegian Blue prefers keepin’ on it’s back!↩

Is MJG teaching that class? He is clearly qualified.↩

Remarkable bird, id’nit, squire? Lovely plumage!↩

Staff sends it to them↩

Staff↩

Rumor says: Nobody, but maybe the latest compliance company through the revolving door is.↩

Accountant? We don’t need no stinking accountant!↩

i.e., you assured me that its total lack of movement was due to it bein’ tired and shagged out following a prolonged squawk.↩

Well, o’course it was nailed there! If I hadn’t nailed that bird down, it would have nuzzled up to those bars, bent ’em apart with its beak, and VOOM! Feeweeweewee!↩

7-6-202. Penalties. A person who knowingly fails to comply with this subchapter shall upon conviction be guilty of a Class A misdemeanor.↩